With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

You can do this ANYTIME and ANYWHERE and for FREE.

The benefits are endless, so there is no need to wait.

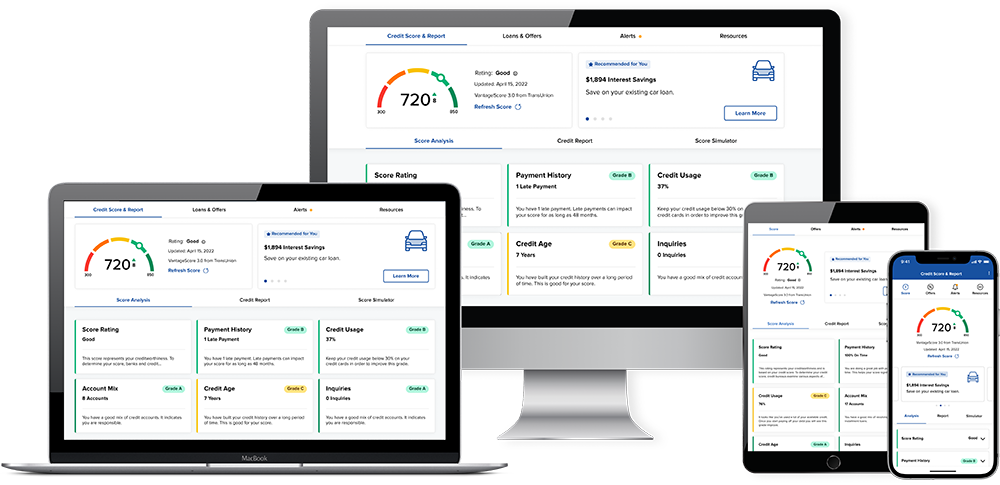

Access your credit score and report in our mobile app and online banking.

Look for "Credit Score & Report"

Follow instructions to enroll and you're set!

A credit score is a three-digit number calculated to indicate your credit worthiness. The higher the score, the more credit worthy you are to a lender. Credit score is calculated from information in your credit report and takes into account whether you have been making on-time payments, your revolving debt use, length of your payment history, and other such factors. It is important to know that your score does not take your age, income, employment, marital status, or your bank account balances into account.

You can learn more about credit scores and scoring models from the Consumer Financial Consumer Financial Protection Bureau website: https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-315/

VantageScore® was founded by the 3 leading credit reporting agencies – Experian, Equifax and TransUnion. This credit score model was developed by a representative team of statisticians, analysts, and credit data experts from each of the credit reporting companies, and is used by hundreds of institutions, including credit unions, banks, credit card issuers and mortgage lenders.

The VantageScore® 3.0, the score that is shown in SavvyMoney, is a newer and more popular version of VantageScore®. It is calculated on a scale of 300-850, with 300 being the lowest and 850 the highest score.

A good score may mean you have easier access to more credit, and at lower interest rates. The consumer benefits of a good credit score go beyond the obvious. For example, underwriting processes that use credit scores allow consumers to obtain credit much more quickly than in the past.

There are five major categories that make up a credit score:

40% Payment History

Essentially what lenders want to know is whether or not you’re good about paying your loans on time.

23% Credit Usage

Credit usage, also known as credit utilization, is the ratio between the total balance you owe and your total credit limit on your revolving accounts. It is best to keep your credit usage below 30%.

21% Credit Age

The age of your oldest account, the age of your newest account, the average age of your accounts and whether you’ve used an account recently are all factors related to the length of your credit history. In general, the longer your credit history the better.

11% Mix of Credit

Your score also takes into consideration how many total accounts you have and what types of credit you have. Your score will likely be higher if you have experience with different types of credit, like mortgages and installment student loans and revolving accounts like credit cards.

5% Recent Credit

Opening multiple credit accounts in a short period of time could represent a greater risk for lenders - those who see that you have multiple recent inquiries may worry that you are applying to so many places because you are unable to qualify for credit - or because you need money in a pinch.

One of the most important misperceptions about credit scores is what information the VantageScore® model, or any credit scoring model for that matter, is NOT used. The VantageScore® model does not consider: race, color, religion, nationality, sex, marital status, age, salary, occupation, title, employer, employment history, where you live or where you shop.