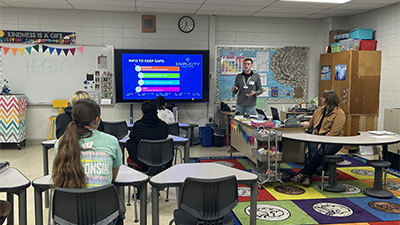

Our team has presentations for all ages, from kid to adult, and we’d love it if you invited us into your classroom, boardroom, or breakroom to share what we know.

Check out the presentations we have ready-made below, fill out the handy form to schedule one, or get in touch, and we can talk about something custom for your group.

Intro to Banking

Remote Banking

Credit Breakdown

Preventing Fraud

Simulations are hands-on activities where participants learn by doing.

Budgeting Simulation

Retire on Track Simulation

Exploring Taxes Simulation

Wants vs Needs (1st Grade Curriculum)

Spend, Save, Share (2nd Grade Curriculum)

Borrowing Money (3rd Grade Curriculum)

Managing a Checking Account (4th Grade Curriculum)

Stock Market Game (5th Grade Curriculum)

Speedy Saver (Age 5-12)

Money Counting Bingo (Age 6-10)

Financial Ratios (Ages 12+)